irs tax levy on social security

The IRS can levy a taxpayers Social Security payments to pay unpaid taxes. If you receive benefits under the Federal Old-Age and.

12 States That Tax Social Security Benefits Kiplinger

If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assetsIt is different from a lien while a lien makes a claim to your assets as.

. Fifty percent of a taxpayers benefits may be taxable if they are. If you are a delinquent taxpayer owing money to the IRS the agency can seize some of your assets including taking money directly from your social security benefits. Under IRC Sec 6331 h the IRS is permitted to levy 15 to pay delinquent tax debts.

Because the FPLP is used to satisfy tax debts the IRS may levy your Social Security benefits regardless of the amount. A common question with delinquent citizens is whether the IRS can levy social security benefits. The IRS does not.

The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099 Social Security Benefit. To levy on Social Security benefits the IRS generally issues Form 668-W to the Social Security Administration SSA. You can also take a few.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. IRS to Limit How Much It Will Seize. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits. If you need help on a Social Security Garnishment the Coast One Tax Group can help.

To levy on Social Security benefits the IRS generally issues Form 668-W to the Social Security Administration SSA. Every year the Taxpayer Advocate Service TAS helps thousands of people with tax problems. To enforce child support and alimony obligations under Section 459 of the Social Security Act 42 USC.

A Final Notice of Intent to Levy is generally the last notice before the IRS takes collection action but when it comes to collecting from someones social security they take an. With the FPLP in effect however the IRS can levy any social security benefits for tax debtors. Ad Use our tax forgiveness calculator to estimate potential relief available.

Under the automated Federal Payment Levy Program the IRS can garnish up to 15 percent of Social Security benefits. For example if your benefit is 1000 the IRS can take up to 150. Social Security and Medicare Withholding Rates.

Ad The Portion of Your Benefits Subject to Taxation Varies With Income Level. For certain civil penalties under the Mandatory Victim Restitution. Prior to 2020 SSI benefits less than 750 per month were exempt from levies.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The current rate for. Get the Help You Need from Top Tax Relief Companies.

A new tax season has arrived. Our team is experienced in resolving cases that involve social security levies and will provide a free. Its Estimated About 56 of Social Security Recipients Owe Income Taxes on Benefits.

Social Security levies like wage levies are continuous and apply until a taxpayers tax debt is paid. The answer unfortunately is yes they can. This story is only one of many examples of how TAS helps resolve taxpayers tax.

The IRS sent you a CP91 notice because you receive social security and according to their records have unpaid back taxes that they plan to offset with a levy on your social. If a levy is placed on your social security benefits the IRS is able to take 15 percent of your social security payments to satisfy your debt. After receipt of the Form 668-W Notice of Levy on.

After receipt of the Form 668-W Notice of Levy on Wages Salary and. A common misconception is the IRS is limited to levying 15 of the social security received. However you will have some time to pay your tax debt before this garnishment occurs.

This is different from the 1996 Debt Collection Improvement Act. The short answer is yes the IRS can place a levy on Social Security benefits. Ad 668-WcDO More Fillable Forms Register and Subscribe Now.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Ad You Dont Have to Face the IRS Alone.

Minimizing Inappropriate Levies In Irs S Federal Payment Levy Program Unt Digital Library

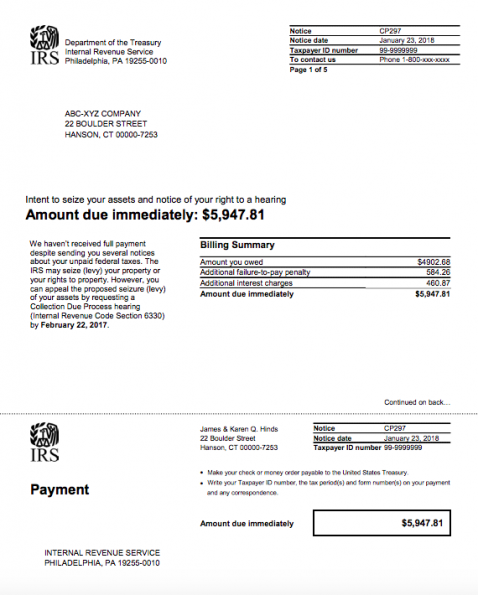

Irs Notice Cp297 What Is Irs Notice Of Intent To Levy Supermoney

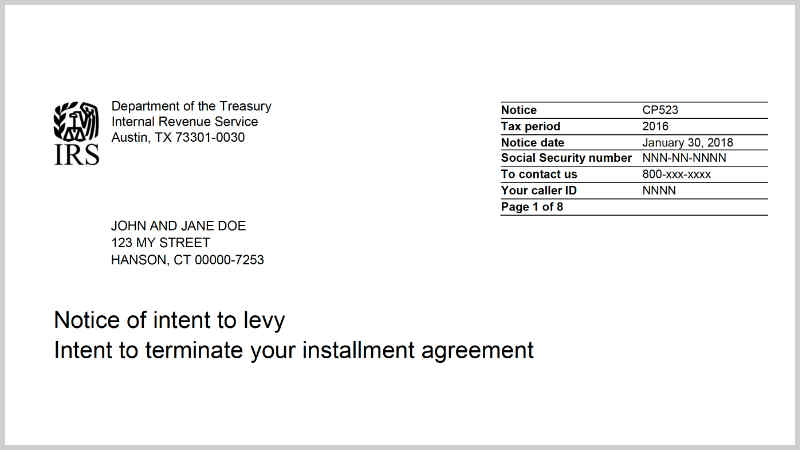

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

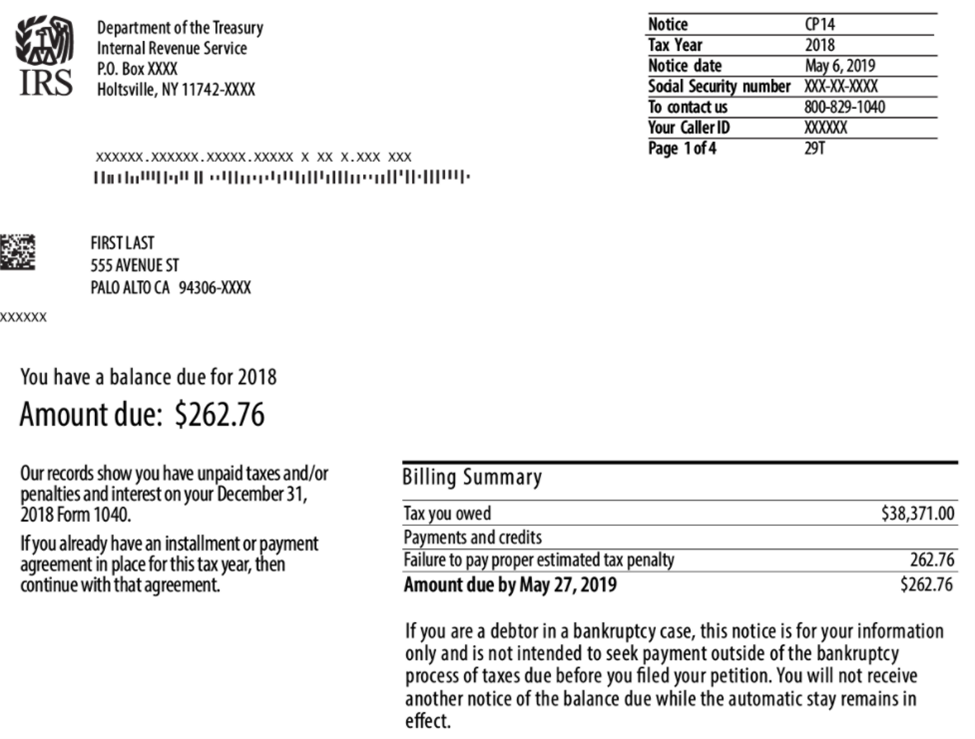

What Assets Can The Irs Legally Seize To Satisfy Tax Debt Paladini Law

Ssdi Federal Income Tax Nosscr

Irs Bank Levy About California Tax Levy Laws Procedure

Irs Can Levy 100 Of Social Security Benefits Windes

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

How Does An Employer Comply With An Irs Wage Levy Wagner Tax Law

Owing Back Taxes And Disablity

Can The Irs Garnish Your Social Security Payments The W Tax Group

Can The Irs Garnish My Social Security Benefits Levy Associates

Notice Cp 91 298 Final Notice Before Levy Of Social Security Benefits Tax Defense Group

Can The Irs Take Your Social Security Check For Back Taxes

What Is A Tax Levy Guide To Everything You Need To Know Ageras

Social Security Tax Considerations Tax Expatriation

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

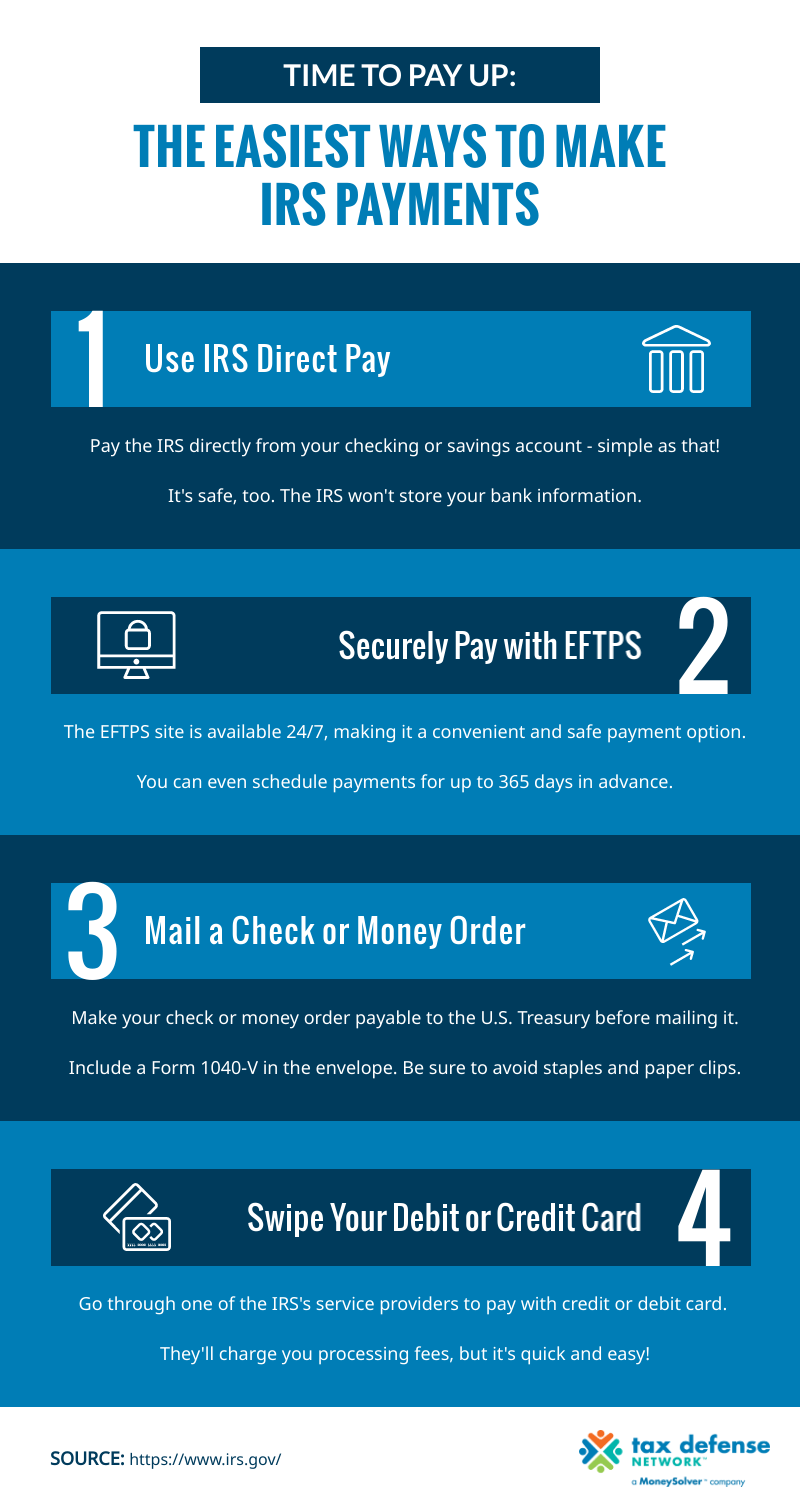

How To Make Irs Payments For Your Taxes Tax Defense Network

Social Security Levy Stop Irs Garnishing Your Social Security